Input Costs & Producer Inflation

Moderate oil prices may ease fuel costs, but continued caution in the energy sector could limit rural economic growth.

Strong balance sheets still matter, but liquidity, planning, and lender relationships are critical as ag credit tightens, according to analysis from AgAmerica Lending.

Rising rural business confidence supports local ag economies, but taxes and labor shortages remain key constraints.

Soft equipment sales signal cautious farm spending as producers prioritize cash flow over expansion.

Rep. Erin Houchin of Indiana discusses how the Affordable Homes Act will benefit rural communities, and her broader efforts to improve access to affordable housing.

Freight volatility increasingly determines export margins, making logistics costs as important as price in marketing decisions.

Larger grain stocks increase supply pressure, but strong fall disappearance — especially for corn and sorghum — suggests demand remains an important offset.

Structural efficiency supports cattle prices and resilience — breaking it risks higher costs and greater volatility.

This simple but powerful tool from Nutrien enables farmers to keep track of highly personalized input costs and expenses involved in running their operation.

Protein markets are fragmenting. Beef is supply-driven and more structurally expensive, whereas pork and poultry remain price-competitive.

Farmer Bridge payments are being used primarily to reduce debt and protect cash flow, not drive new spending. Curt Blades with the Association of Equipment Manufacturers joined us to provide insight into the ag equipment market and the factors influencing sales.

As the new year begins, both farmers and rural families are taking stock of their finances and planning ahead for 2026.

Strong export demand supports feed grain prices, but drought risk and seasonal patterns favor disciplined early-year marketing.

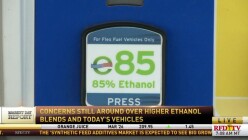

Strong crush demand and rising ethanol production are pressuring feedstocks, as traders monitor storage risks and supply chain uncertainty and await the upcoming January WASDE report.

Last year was a busy year for pesticide litigation in the United States. At No. 10, it kicks off RFD-TV Legal Expert Roger McEowen’s list of the “Top 10” Agricultural Law and Tax Developments of 2025.

Benchmark machinery costs against those of similar-sized, high-performing operations to inform equipment and investment decisions.

Record pace corn exports are helping stabilize prices despite softer global grain production and ongoing supply competition.

Reviewing risk management now can help dairy and livestock producers enter 2026 with clearer margins and fewer surprises.

Stronger rail movement and lower fuel prices are easing logistics, even as export pace and river conditions remain uneven.

Recent USDA export sales data show China has been active in the U.S. market, but analysts tell RFD-TV News that the timing is a key clue.

Tight feeder supplies and lower placements indicate continued support for the cattle market, with regional impacts heightened in Texas by reduced feeder imports.

Larger operations maintain cost advantages, while softer equipment sales suggest producers are pacing machinery upgrades amid tighter margins.