“Firm to Farm,” the RFD-TV Business Blog by agri-legal expert Roger McEowen, dives into the agricultural law and business taxation topics important to American farmers.

Contracts

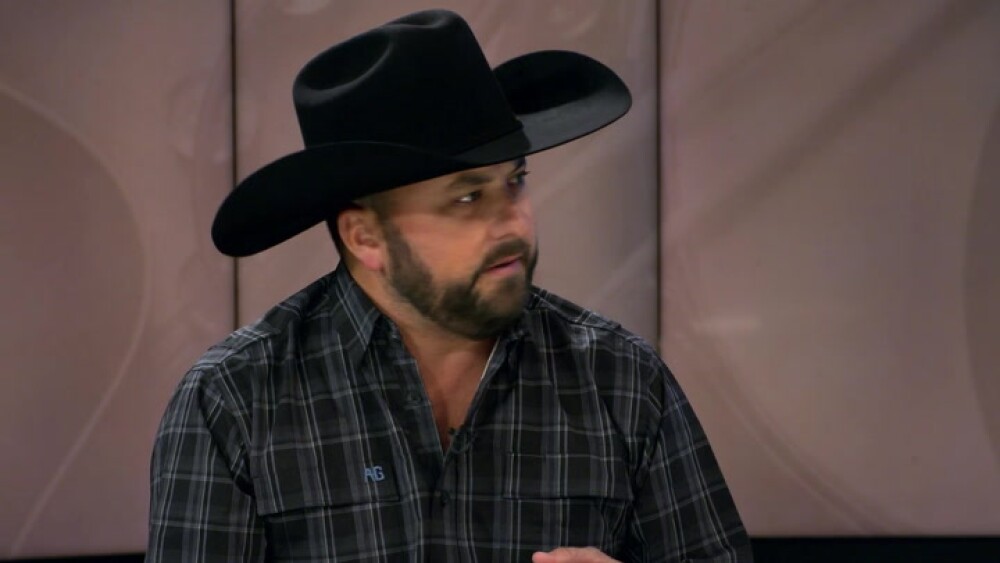

Farm legal and taxation expert Roger McEowen discusses tariffs’ impacts on agriculture, deferred payment contracts, tax easement issues, and the rise in warrantless searches on farms and ranches.

In his latest Firm to Farm blog post, Ag Legal & Taxation Expert Roger McEowen examines contracts, insurance, and property rights and how those legal processes can impact your farm or ranch operation.

Digital contracts are becoming more common for farmers and ranchers, which means some unique legal issues might arise. RFD-TV’s farm legal expert Roger McEowen briefly examines those.

Secured Transactions

What are the relative advantages and disadvantages of the split-interest transaction? And what are the rules when property that was acquired in a split-interest transaction is sold? That is the topic of today’s blog post by RFD-TV Agri-Legal Expert Roger McEowen.

A split-interest transaction involves one party acquiring a temporary interest in the asset (such as a term certain or life estate), with the other party acquiring a remainder interest. That is the topic of today’s Firm to Farm blog post by RFD-TV Agrilegal Expert Roger A. McEowen.

The “farm products rule,” and the 1985 Farm Bill modification and its application – that is the topic of today’s blog post from Agri-Legal Expert Roger McEowen.

Bankruptcy

RFD-TV Farm Legal and Tax Expert Roger McEowen with the Washburn School of Law dives into a “potpourri” of ag tax and law-related issues in his latest Firm to Farm blog post.

What is “gross income from farming” for purposes of Chapter 12 (farm) bankruptcy – that is the topic of today’s Firm to Farm blog post by Roger McEowen.

Today’s blog post by RFD-TV Agri-Legal Expert Roger McEowen takes a look at the “preferential payment rule,” a unique bankruptcy provision that can come as a suprise to farmers in financial distress.

Farmland Real Estate

The specific provision in the CO₂ storage law allowed the North Dakota Industrial Commission (NDIC) to authorize carbon storage projects to proceed even if they lacked unanimous consent from all affected landowners.

For many farm businesses, property taxes on business assets have become a significant and highly visible expense, threatening liquidity, discouraging investment, and creating a disproportionate burden when compared to other industries.

The allure of rural property — with its promise of space, freedom, and self-sufficiency — is undeniable, but local zoning regulations govern the reality.

Want more agri-legal insights from Roger McEowen?

Catch his regular appearances on RFD-TV’s Market Day Report.

Every day, “Market Day Report” delivers “live” coverage of agri-business news, weather, and commodity market information from across the world. Our market coverage is constantly updated every half-hour, bringing you the latest on the markets.

Farm Legal Expert Roger McEowen with the Washburn School of Law joins us to share more about the North Dakota court decision and the its larger impact on agriculture.

RFD-TV Farm Legal and Tax Expert Roger McEowen explains the basics of Low-Risk Credit in Farming, and how an understanding of the farm credit landscape lets producers tactfully approach debt.

Farm legal expert Roger McEowen reviews the history of the Waters of the United States (WOTUS) rule and outlines how shifting definitions across multiple administrations have created regulatory confusion for landowners.

Kansas Farm Bureau Professor of Agricultural Law and Taxation with the Washburn University School of Law

Trending Stories

- Landowner Victory in North Dakota Raises Questions for Carbon Capture Infrastructure Nationwide

- China’s Retreat Slashes U.S. Farm Exports in 2025

- China’s Pullback Reshapes U.S. Export Markets Heading into 2026, Strong Corn Exports Offer Bright Spot

- Rail and Trucking Changes Reshape Agricultural Transportation Outlook

- StoneX: Tariff Threat on Canadian Fertilizer Could Disrupt U.S. Supply and Prices

- What are the options if the Supreme Court rules against the Trump Administration’s tariffs?

- Music City Celebration Cattle Sale Celebrates Another Year of Success

- Cattle Sector Monitors Forecast as Frigid Temperatures Spread Nationwide

Latest Stories

- Tyler Farr keeps it real with his new EP “Quit Bein’ Country”

- Champions of Rural America: Rep. Dan Newhouse’s Goals for His Last Year in Congress

- Protecting Producers: Rural law enforcement wants to keep everyone safe on their roads

- Founder of Global Ag Protein discusses the current main market movers and her Dirt Diaries Podcast episode

- On the Record | Cody Johnson knew immediately that Carrie Underwood was the voice for their #1 duet “I’m Gonna Love You”

Latest Stories: Business

Larger operations maintain cost advantages, while softer equipment sales suggest producers are pacing machinery upgrades amid tighter margins.

Analysts say that while low-income households are facing financial pressures, other middle- and higher-income consumers are helping fill the gap for retail beef demand.

Corn and wheat exports remain supportive, but weaker soybean demand — especially from China — continues to pressure oilseed markets.

Slower grain movement may pressure basis, but falling diesel prices could help offset transportation costs.

Plans are underway for the 27th annual Great Eastern Iowa Tractorcade, a June event celebrating farm heritage, tractor history, and rural traditions. Event manager Matt Kenney joins us to highlight the importance of commemorating farm heritage.

A new study found that retaining the EPA’s half-RIN credit protects soybean demand, farm income, and crushing-sector strength while preserving biofuel market flexibility.

The U.S. has a bountiful corn supply, but markets are waiting for the January WASDE Report, which will include updated yield estimates.

Freight Softens as Producers Plan 2026 Budgets Nationwide

“I’m not sure where this bridge goes,” trader Brady Huck with Advanced Trading told RFD-TV News earlier this week.

CoBank’s 2026 Year Ahead Report cites global grain oversupply, easing inflation, rate cuts, and major data center growth that could reshape rural America.

Plan for sharp, short-term volatility after unexpected outages; permanent closures rarely trigger major price spread disruptions.

Ethanol output softened, but underlying supply-and-demand trends indicate stable longer-term use despite short-term volatility in blending and exports.