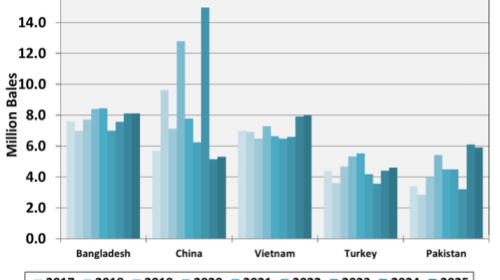

LUBBOCK, Texas (RFD-TV) — China continues to play a decisive role in the international cotton market, even as it leads the world in production. For the 2025 crop year, Chinese output is projected at 31.5 million bales. However, the country still imported 5.3 million bales, ranking just behind Bangladesh, Vietnam, and Pakistan.

Import patterns are dictated by government quotas, which allow 894,000 tons at a low tariff rate of one percent, while additional imports face a 40 percent tariff.

“So, in the case of cotton, they don’t have a lot of other countries to turn to other than the United States; there aren’t that many countries that grow that cotton,” Midwest Marketing Solutions President Brian Hoops told RFD-TV News. “You look at where they can buy soybeans from—well, they have a monster crop out of South America, both Brazil and Argentina this year. Big corn crops out of Brazil, record-large there. They can buy corn and soybeans from other countries.”

Economists with the University of Georgia and the Georgia Cotton Commission explain that these policies, along with reserve stock programs, can cause dramatic swings in demand from year to year. Heavy purchases in 2023 lifted global demand, but reduced China’s need for imports in 2024 while boosting domestic output.

Past examples, including the 2012–2014 period, demonstrate that reserve build-ups followed by cutbacks can exert lasting pressure on global prices.