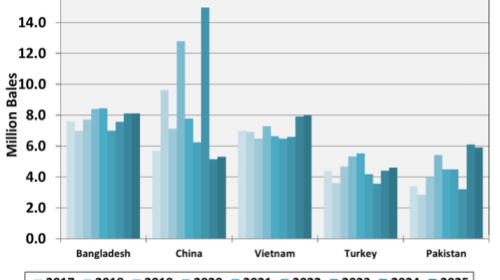

LUBBOCK, Texas (RFD-TV) — China continues to play a decisive role in the international cotton market, even as it leads the world in production. For the 2025 crop year, Chinese output is projected at 31.5 million bales. However, the country still imported 5.3 million bales, ranking just behind Bangladesh, Vietnam, and Pakistan.

Import patterns are dictated by government quotas, which allow 894,000 tons at a low tariff rate of one percent, while additional imports face a 40 percent tariff.

“So, in the case of cotton, they don’t have a lot of other countries to turn to other than the United States; there aren’t that many countries that grow that cotton,” Midwest Marketing Solutions President Brian Hoops told RFD-TV News. “You look at where they can buy soybeans from—well, they have a monster crop out of South America, both Brazil and Argentina this year. Big corn crops out of Brazil, record-large there. They can buy corn and soybeans from other countries.”

Economists with the University of Georgia and the Georgia Cotton Commission explain that these policies, along with reserve stock programs, can cause dramatic swings in demand from year to year. Heavy purchases in 2023 lifted global demand, but reduced China’s need for imports in 2024 while boosting domestic output.

Past examples, including the 2012–2014 period, demonstrate that reserve build-ups followed by cutbacks can exert lasting pressure on global prices.

Tony’s Farm-Level Takeaway: For U.S. growers, the uncertainty adds risk during harvest and marketing. China’s buying decisions continue to be a critical factor in shaping cotton prices and export opportunities worldwide.

According to the Louisiana Department of Agriculture and Forestry, fire crews remain on alert statewide as Red Flag conditions persist. Officials warn that even contained fires can reignite quickly under current weather conditions.

February 24, 2026 05:46 PM

·

Glyphosate and phosphorus are deemed critical to U.S. national defense, ensuring farmers’ access while signaling a shift toward regenerative agriculture. RealAg Radio host Shaun Haney shares insight on the Trump Administration’s move and what it could mean for U.S. farmers moving forward.

February 24, 2026 01:30 PM

·

Ag leaders say President Donald Trump’s State of the Union is unlikely to spark major agriculture headlines, but ongoing tariff uncertainty and trade policy remain key concerns, as does the debate around glyphosate and the status of the next Farm Bill.

February 24, 2026 11:57 AM

·

Cotton jassid, a invasive pest, is raising concerns for Southeast cotton growers as experts work to understand its impact this season.

February 24, 2026 09:00 AM

·

Expanded global trade access boosts long-term export demand potential for U.S. ag products.

February 23, 2026 03:03 PM

·

For the broader agricultural industry, a railroad antitrust case in Kansas could lead to the dismantling of legacy regulatory shields, creating a more fluid, market-driven transportation grid that prioritizes moving crops efficiently over protecting historic rail monopolies.

February 23, 2026 11:35 AM

·