NASHVILLE, Tenn. (RFD-TV) — Real Christmas tree growers face rising competitive and structural pressures as imported artificial trees expand sharply in U.S. markets. With most American families unaware of the decade-long timeline required to grow a marketable tree, the industry is increasingly challenged by weather volatility, labor shortages, and long-term acreage decline.

Production capacity has contracted significantly, says the American Farm Bureau Federation (AFBF). Between 2002 and 2022, farms harvesting Christmas trees fell nearly 30 percent, and acreage dropped more than 150,000 acres, a 35 percent reduction shaped by complex economics and slow biological timelines. Retail-ready trees typically require seven to 10 years to grow, exposing farmers to years of insect pressure, disease risk, and extreme weather.

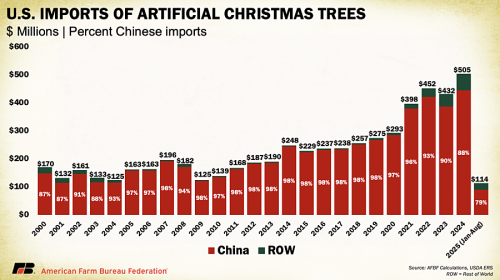

According to the American Farm Bureau Federation, artificial trees — 85% to 95% imported from China — have become the dominant competitor, replacing years of real-tree demand with a single purchase. Imports have surged from $170 million in 2000 to more than $500 million in 2024, exerting continuous price pressure on domestic growers.

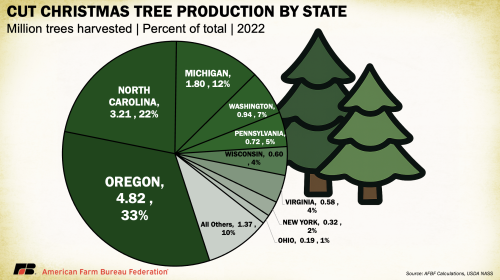

Regionally, Oregon and North Carolina lead production, while farms nationwide face rising labor costs, land constraints, and limited risk-management tools that offer little protection from multiyear losses.

Looking ahead, growers say consumer choices are increasingly tied to farm survival, as U.S.-grown real trees support domestic jobs, preserve open space, and sequester carbon throughout their decade-long growth.